Having difficulty managing a financial portfolio? In this period of economic woes one has to be very prudent—nay, wise, in making investments or any financial move for that matter, so as to maximize the value of every dollar that comes out of one’s pocket. One area that constantly poses a problem for everyone is the use of a credit card. If an individual is not careful and not cautious in choosing what card to use and how to use it, one will find oneself entangled in a web of charges and interests that makes him forever shackled in debt.

But there is one best kept secret that could help untangle that chain of indebtedness and that is the smart way of playing around with current offers on balance transfers which have proved to significantly reduce the charges and interests, giving the cold-shoulder a breather in managing his card balances. Therefore, it is always essential that one is on top of the indices of balance transfer movements and the ramifications of the same. A thorough analysis of the data hereunder is presented could spell the difference in terms of dollar savings.

The SmartBalanceTransfer.com index revealed some initial rate variations at the beginning of this year; however, durations remained at approximately 13 months with an average balance transfer fee of 3%. According to reliable baseline data generated from the past several months, the balance transfer market has shown a predominately steady rate of progression which should continue to hold through this month of June.

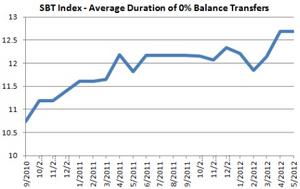

The general movement of the 0% top balance transfer promotional lengths has remained relatively consistent in the previous months to date. The average term of offers; on the other hand, have been slightly wavering between the figures of about 12.5 to 13 months in duration, shortly after dropping to below 11 months in the fall of 2010. The recorded fluctuation in numbers may have been affected by the rates maintained by Chase Slate, which offered a staggering 15 months of 0% interest on balance transfers; as well as, new purchases using their Freedom rewards card that incurs a 3% balance transfer fee.

The current trend of top balance transfer offer fees that suggest the absence of any major inflections that would merit any significant concern. In fact, this range of balance transfer rates has clearly lingered at 3% and shows no sign of change in the near future. Given that Chase Slate retains its no-fee offers; which had been temporarily matched by Discover in the early part of the quarter, no further fluctuations would be seen in the standard progression of the market.

In the same way as the duration of balance transfer promotions are displaying long term increases, the average balance transfer rates of fees are indicative of a prolonged decline, which was seen to move subtly at almost 4% in middle of 2010. This positive movement is typically symptomatic of a well-balanced state for consumers. The present activity that we are seeing would be ideal for those with long-term plans in transferring high interest balances to a low interest cards. However; should the no-fee offer by Slate is suddenly withdrawn, the average fees will immediately soar to more than 3% and at a rapid rate.

Although the projected amount of profit that a bank earns in credit cards are at a steady pace of growth, the level of debt incurred by consumers are considerably low. In essence similar incentives; by way of these balance transfer promotions and various sign-up bonuses, continue to be priorities due to the fact that they weigh heavily as effective strategies to retain customers and obtain more in the process. If the tendencies of the market persist; as is the case of stable rates indicates, the flow of offers will inevitably remain.

A useful tool that may provide a comparative analysis of different cards which may prove to be suitable for your needs may be attained at: http://www.smartbalancetransfers.com/balance-transfer-search-assistant/